IOL Fluorochemical Weekly Report: Refrigerants continue to have strong production and sales, while fluorinated polymers continue to have strong supply and weak demand

One week market

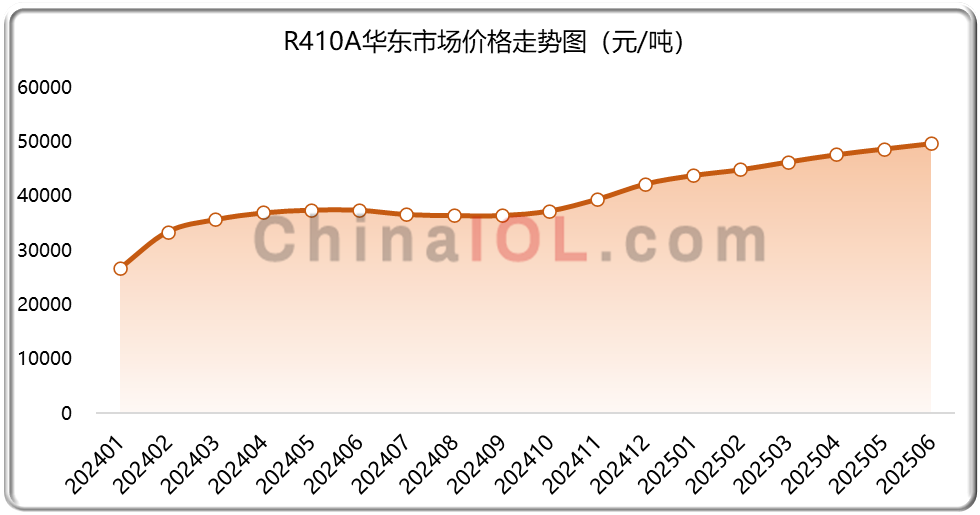

Refrigerant: There is no "internal competition" in the domestic and foreign trade markets, and the price remains stable

This week, the refrigerant market continued the pattern of strong production and sales, and product prices remained stable. On the supply side, the proportion of quota consumption for hot selling HFC products HFC-32 and HFC-34a in the first half of the year reached 55.8% and 52.2%, respectively. Due to the high concentration of HFC production quotas in the industry, mainstream production enterprises such as Juhua, Sanmei, Sinochem, Dongyue, Meilan, Dongyang, Yonghe, etc. have consumed quotas for popular products at a rate ranging from 40% to 75%. On the demand side, in the cold year of 2025, the domestic air conditioning shipment volume may exceed 100 million sets, setting a new historical high. The production and sales scale of the automotive industry in the first half of the year will exceed 15 million units, with a vehicle growth rate of over 10% and a new energy vehicle growth rate of over 30%. The structural growth characteristics are significant. The impact of cost on refrigerant prices is mainly reflected in fluctuations in raw material prices. Due to the oversupply of most raw materials, prices have bottomed out and stabilized, resulting in a relatively low and stable cost center for refrigerants. In summary, the current loose supply of raw materials, quota policies controlling industry supply, and steady growth of downstream application industries provide essential support for refrigerant demand. In addition, refrigerant companies have not experienced "internal competition", and the market prices are operating in an orderly manner to maintain stability and explore price increases.

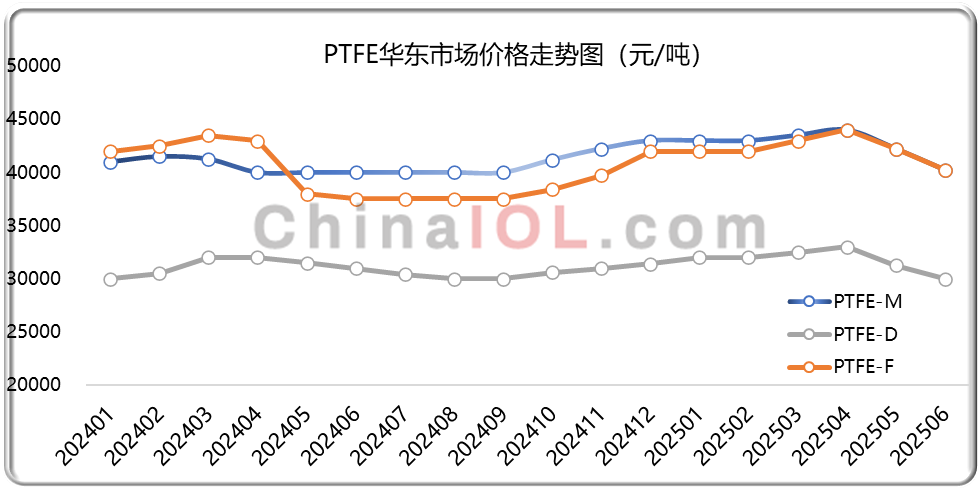

Fluorinated polymers: Continuing the pattern of "strong supply and weak demand", product prices are under pressure and moving forward

This week, the fluorine-containing polymer market is facing a dilemma of "strong supply and weak demand", and product prices at all links of the entire industry chain are struggling to operate under downward pressure. Market characteristics of the week: On the supply side, the contradiction of overcapacity has intensified, the operating rate has declined, and the inventory turnover days of mainstream products have significantly extended. On the cost side, the prices of basic raw materials have hit bottom, and the negative cycle continues to exert pressure on the prices of basic raw materials, causing a significant decline. Prices of fluorite, hydrogen fluoride, chloroform, and other materials have fallen to their lowest levels in nearly three years. Demand side: Traditional industries have weak growth, and emerging fields are difficult to fill the gap. Specifically in the application industry, traditional application industries such as engineering and construction, machinery manufacturing, and coatings have experienced slow growth, and even negative growth; In emerging application fields such as new energy, semiconductors, and high-end manufacturing, although demand has increased, the growth rate is far behind the supply growth rate, making it difficult to reverse the market supply-demand imbalance. Overall, it is expected that the prices of fluorinated polymer products will continue to fluctuate at the bottom in the short term. Some small and medium-sized enterprises will face severe challenges such as clearing production capacity and being acquired through mergers and acquisitions.

This Week

01Juhua Corporation: Net profit for the first half of the year is expected to increase by 136% to 155% year-on-year

On July 8th (600160. SH), Juhua Corporation announced that it expects its net profit attributable to the parent company to reach 1.97 billion yuan to 2.13 billion yuan in the first half of 2025, a year-on-year increase of 136% to 155%; The net profit after deducting non attributable expenses was 1.95 billion yuan to 2.11 billion yuan, a year-on-year increase of 146% to 166%. The main reason for the significant increase in the company's performance in this period is the sustained recovery in the price of the company's core product fluorine refrigerant, as well as the stable growth in the production and sales volume of the company's main products, and the increase in gross profit and profitability of its main business.

02Haohua Technology: Net profit for the first half of the year is expected to increase by 59.3% year-on-year to 75.5%

On July 8th, Haohua Technology announced that it expects to achieve a net profit attributable to the parent company of RMB 590 million to RMB 650 million in the first half of 2025, an increase of RMB 220 million to RMB 280 million compared to the same period last year, with a year-on-year growth rate of 59.30% to 75.50%. The main reason for the expected increase in performance this time is the completion of the merger between China National Chemical Corporation Blue Sky Group Co., Ltd. and Guilin Lanyu Aviation Tire Development Co., Ltd. The integrated management of fluorine chemical business and the high rise in refrigerant product prices have also driven the growth of the company's gross profit.

03The 9000t/a trifluoroacetic acid and other product projects of Chuangying Chemical have landed in Jinchang, Lanzhou

On July 5th, the 31st China Lanzhou Investment and Trade Fair (Lanzhou Fair) Jinchang Investment Promotion and Key Project Signing Ceremony was held in Lanzhou. The contracted projects include the production line project of Jinchang Chuangying Chemical Technology Co., Ltd. with an annual output of 9000 tons of trifluoroacetic acid, 500 tons of ethyl trifluoroacetate, and 200 tons of trifluoroacetic anhydride. It is reported that the total investment of the project is 250 million yuan, located in Hexibao Industrial Park, Yongchang County. The first phase plans to construct 3000t/a trifluoroacetic acid, 500t/a trifluoroacetic acid ethyl ester, and 200t/a trifluoroacetic acid anhydride, and the second phase plans to construct 6000t/a trifluoroacetic acid.

04Hunan Province discovers 490 million tons of lithium ore, bringing significant benefits to the new energy industry

Lithium is known as the "white oil" and as a key raw material for emerging industries such as new energy vehicles and energy storage, it is crucial for the global transition to clean energy. As a major producer of lithium batteries, China has a strong demand for lithium. According to Xinhua News Agency, on July 8th, reporters learned from the Department of Natural Resources of Hunan Province that a super large altered granite type lithium deposit has been discovered in the Jijiaoshan mining area of Linwu County, Chenzhou City, Hunan Province. A total of 490 million tons of lithium ore and 1.31 million tons of lithium oxide resources have been submitted. At the same time, this super large mineral is associated with various strategic minerals such as rubidium, tungsten, and tin, all of which are newly added resources, which can effectively promote the implementation of the national lithium resource guarantee strategy.