IOL Fluorochemical Weekly Report: Unequal distribution of cold and hot products in the refrigerant market, with hot products showing steady growth and exploration

One week market

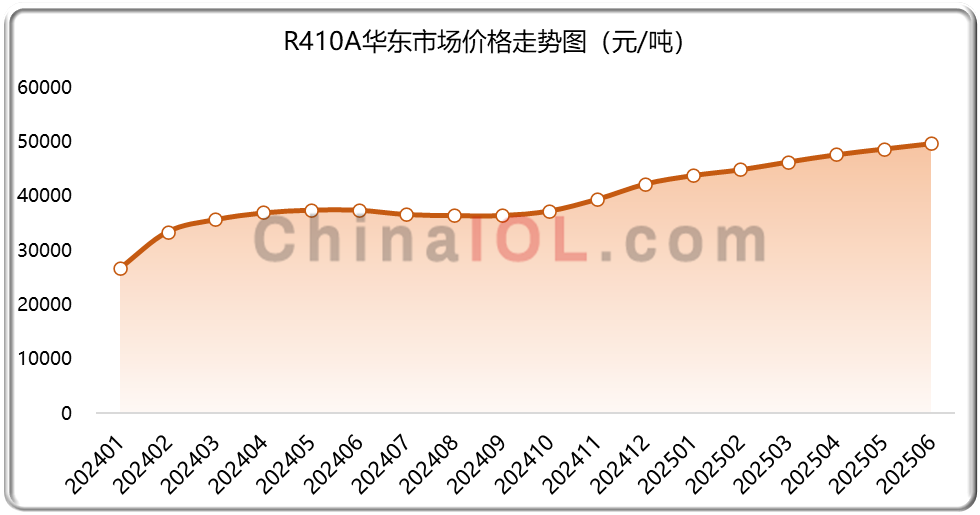

Refrigerant: Different products continue to experience uneven heating and cooling in the short-term market, maintaining stability and exploring price increases

This week, the refrigerant market continued to experience uneven heating and cooling, with popular products R32 and R134a showing a significant increase in price, while related mixed refrigerants saw a slight rise. Other varieties with reduced demand due to environmental substitution, such as R125, R143A, and related mixed refrigerants R407C, R404A, and R507, showed relatively weak price increases, with clear and intuitive feedback on price trends. Market characteristics of the week: Due to the reduced production and sales of the refrigerant industry chain, the supply-demand contradiction of upstream basic raw materials such as fluorite powder, hydrofluoric acid, methane chloride, PCE has intensified, and prices are running at a low level. The operating load of refrigerant factories on the supply side is also uneven, with popular products such as R32 and R134a being mostly produced at full capacity, while demand for products is reduced, and factories are experiencing load reduction or parking. The demand side core application area of the air conditioning industry continues to grow domestically, but the export market has declined significantly; The automotive industry is showing a structural growth of "new energy replacing fuel vehicles", with high export prosperity, but overall growth rate is not high; Overall, the industry pattern of tight supply-demand balance in the domestic and foreign trade markets has strong continuity, and the short-term refrigerant market will continue to maintain stability and explore growth.

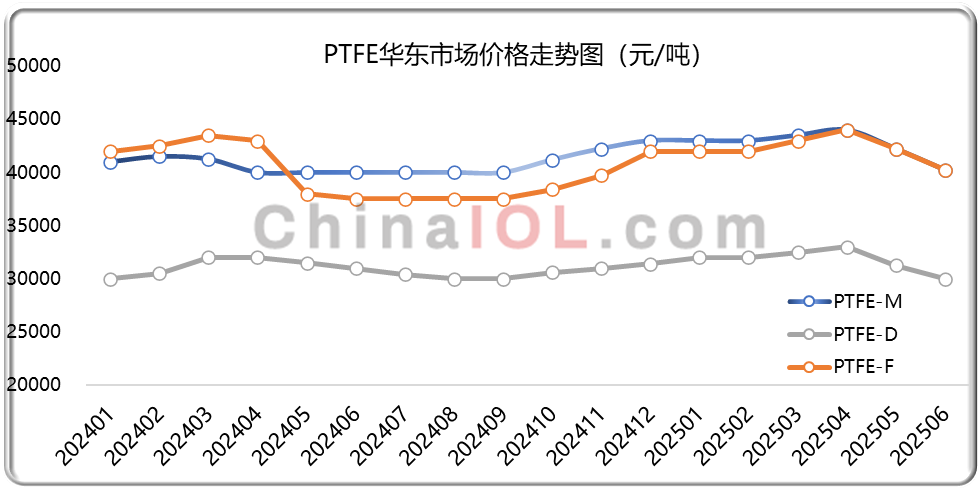

Fluorinated polymers: oversupply, weak demand, industry chain facing pressure of both quantity and price decline

This week, the fluoropolymer market continued to experience oversupply, weak demand, and negative pressure on the industry chain due to a simultaneous decline in both quantity and price. In recent years, both new and old enterprises on the supply side have expanded their production significantly, further exacerbating the supply-demand imbalance. Poor shipments have in turn constrained industry operations, thereby affecting costs. The cost side is experiencing a cycle of "weak production and sales → relatively reduced factory production → reduced raw material demand → oversupply of raw materials → falling raw material prices → weakened cost support → declining product prices", with core raw material prices falling to new lows, and most product costs hitting new lows in recent years. On the demand side, traditional engineering and construction, machinery manufacturing, petrochemicals, aerospace, coatings, etc. either continue to be weak or have low growth rates. In new application areas such as new energy, semiconductors, high-end manufacturing, environmental protection, medical and other new sub sectors, the demand growth rate is far lower than the supply growth rate. In summary, although the policy of domestic substitution has positive support for the industry, the supply-demand relationship and cost side negative effects still need time to be digested. The short-term fluorine material market will continue to remain weak and consolidate, falling. More increase, less increase.

This Week

01Confirmation of the first quota adjustment for HCFCs and HFCs in 2025

On June 20th, the Ministry of Ecology and Environment issued a reply approving 14 enterprises including Zhejiang Lanxi Juhua Fluorochemical Co., Ltd. to adjust their production quotas for hydrochlorofluorocarbons and hydrofluorocarbons for the year 2025. Among them, Sinochem and Juhua respectively reduced their quotas for R134A by 2000 tons, while Dongyang increased by 4456 tons. Dongyang also reduced its quota for R125 to 456 tons of R134A. Feiyuan reduced its production quota of 1900 tons of R32 and 1200 tons of domestic production quota, and transferred them to Juhua (Quhua Fluorochemical). Quhua Fluorochemical added 1900 tons of R32 production quota and 1200 tons of domestic production quota. Luxi Chemical's R32 production quota has increased by 414 tons, and the domestic production quota has increased by 272 tons.

02Announcement of the pilot project for the first process demonstration of China Salt Red Tetrachloropropene

In January 2025, the environmental impact assessment report for the pilot project of the first set of process demonstration for tetrachloropropene of China Salt Anhui Hongsi Fang Co., Ltd. was publicly released. The project is located in the southern factory area of Anhui Red Sifang Co., Ltd. in Hefei Circular Economy Demonstration Park. After completion, it can form a pilot capacity of 500 tons of 1,1,1,3,3-pentachloropropane, 500 tons of 1,1,1,2,3-pentachloropropane, and 100 tons of tetrachloropropene. Tetrachloropropene is a colorless liquid with strong chemical stability and is generally not prone to reactions. It can be used as a raw material to prepare HFO-1234yf.

03The construction of the 62000 tons/year electrolyte project of Dongying Chemical, a subsidiary of Sanmei, has been postponed

On June 23rd, Sanmei Corporation announced the progress of its wholly-owned subsidiary's external investment projects. The announcement pointed out that Fujian Qingying Chemical Co., Ltd., a wholly-owned subsidiary of Sanmei Group, plans to invest approximately 1.072 billion yuan to construct the "62000 tons/year electrolyte and supporting engineering project". However, as of now, the project has not been substantially put into construction and the completion deadline will be extended to June 2027. The announcement stated that the main reason for the project delay is the significant changes in the market environment of the electrolyte industry, especially the increasing demand for cost control in downstream lithium batteries and new energy vehicles, which has led to a shift in the supply and demand structure of the electrolyte market. The lithium hexafluorophosphate industry is facing a situation of slowing demand growth, overcapacity, and low prices.

04New progress of Liwen Chemical and Jiujiang Tianci Fluorine Chemical projects

On June 23rd, the Ecology and Environment Bureau of Jiujiang City made an approval/proposed approval decision on the environmental impact assessment documents for the trifluorochloroethylene and supporting projects of Jiangxi Liwen Chemical Co., Ltd. and the annual production of 40000 tons of lithium difluorosulfonylimide expansion project of Jiujiang Tianci New Power Material Technology Co., Ltd., and made it public. Jiangxi Liwen plans to build a new 10000t/a trifluorochloroethylene (CTFE) plant, producing 1000t/a trifluorochloroethylene (TrFE) and supporting the construction of 20000t/a trifluorochloroethylene (R113). The product plan of Jiujiang Tianci is to produce 40000 tons of lithium bis (fluoroyellow) imide solution annually and configure it into 106666.6 tons of 30% EMC lithium salt solution and 26666.6 tons of 30% DMC lithium salt solution.