IOL Fluorochemical Weekly Report: Driven by "rigid supply and rigid demand", the center of gravity of refrigerant prices continues to shift upwards

One week market

Refrigerant: The rigid supply and demand market is clearly favorable, and the prosperous market will continue

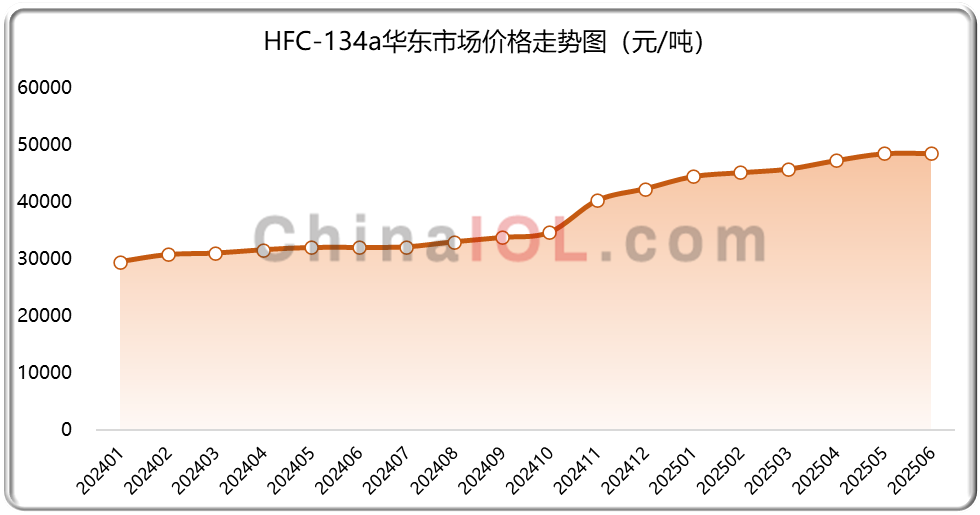

This week, the refrigerant market presented a dual wheel drive pattern of "supply rigidity+demand rigidity", with most products smoothly supported by production and sales, and the price center continued to shift upward. Market characteristics of the week: Upstream basic raw materials such as fluorite powder, hydrofluoric acid, methane chloride, TCE, etc. are generally balanced in supply and demand, maintaining monthly prices with minimal price fluctuations. Supply side refrigerant production enterprises operate differently with different refrigerant products. Popular refrigerant products such as R32 and R134a are mostly produced at full capacity in factories, while products with poor production and sales have sporadic instances of factory load reduction or parking. The demand side core application area, the air conditioning industry, continues to have high production capacity, while the demand in the automotive industry is stable with an upward trend. In addition, the export demand is stable, and the maintenance market is gradually starting. It is expected that the short-term refrigerant market will continue to operate at a high level.

Fluorinated polymers: insufficient cost support, supply-demand contradiction, short-term difficult to change price pressure, exploring chassis consolidation

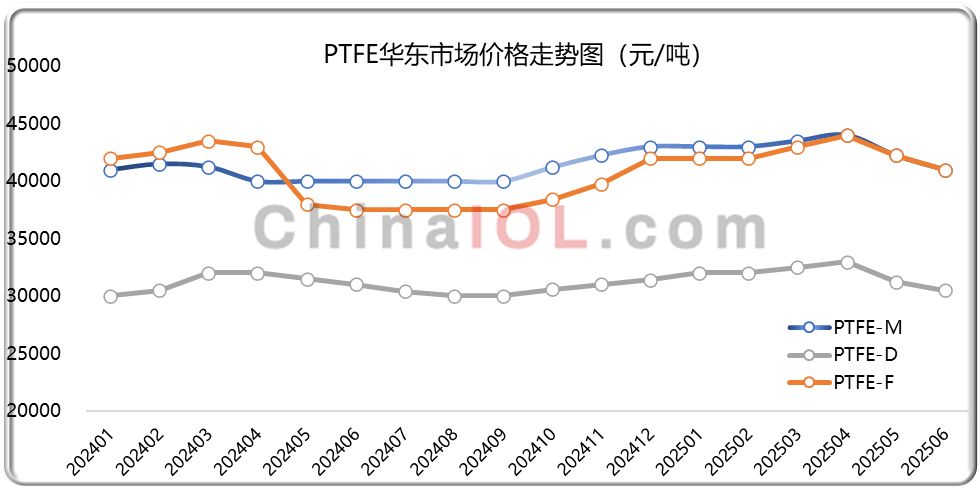

This week, the fluoropolymer market was affected by factors such as the summer off-season, relative oversupply, and weakened cost support, resulting in weak prices for mainstream products and bottoming out operations. With comprehensive product competition in terms of cost, quality, price, and industrial chain, leading enterprises are resolving overcapacity through technological upgrades and innovative application scenarios in segmented tracks. The cost side is limited by the decrease in production and sales of fluorinated polymers, which has a negative impact on upstream raw material demand. In turn, the weakening of core raw materials continues to bring down the cost center of downstream products, with TFE series and HFP series products experiencing a collective decline. On the demand side, traditional engineering and construction, mechanical manufacturing, petrochemicals, aerospace, coatings and other industries are slowly recovering, while new application areas such as new energy, semiconductors, high-end manufacturing, environmental protection, medical and other new sub sectors have limited industry growth. Overall, against the backdrop of slow global economic growth, the supply-demand imbalance of mainstream fluoropolymers is difficult to resolve in the short term, coupled with weakened cost support. The fluorine material market will continue to operate under pressure from general material prices, while the market pattern for high-end products is slightly better.

This Week

0114 companies apply to adjust their production quotas for HCFCs and HFCs for the year 2025

Recently, the Ministry of Ecology and Environment received applications from 14 enterprises, including Zhejiang Lanxi Juhua Fluorochemical Co., Ltd., to adjust their production quotas for HCFCs and HFCs in 2025, and publicly announced the production quota adjustments of the 14 enterprises mentioned above. Quota adjustment products involve HCFC-22、HFC-32、HFC-134a、HFC-125、HFC-143a、HFC-152a、HFC-227ea、HFC-245fa, The total amount before and after adjustment has not changed.

02Shandong Aofan 34000 ton fourth generation new fluorine material project (Phase I) upgrade and renovation project public announcement

On June 11th, the Ecological Environment Bureau of Zibo City accepted the Environmental Impact Assessment Report of the 34000 ton annual fourth generation new fluorine material project (Phase I) upgrade and renovation project of Shandong Aofan New Materials Co., Ltd. and made it public. The project is located in Gaocheng Town Chemical Industry Park, Gaoqing County, Zibo City, Shandong Province, with a planned investment of 60 million yuan. It aims to upgrade and transform the existing unit for co producing tetrafluoropropene and pentafluoropropane with monochlorotrifluoropropene, and add a tetrafluoropropene separation and purification unit and corresponding facilities to optimize the production process and product structure. After the completion of the project, the total production capacity of the device will remain unchanged at 16000t/a, and the product structure will be optimized to a flexible capacity configuration of 10000 tons/year of monochlorotrifluoropropene, 5000 tons/year of pentafluoropropane (maximum), and 5000 tons/year of tetrafluoropropene R1234ze (maximum).

03Shandong Zhongrou 3000 tons/year hexafluoropropane project acceptance announcement

On June 4th, Shandong Zhongrou New Materials Co., Ltd. announced the completion and environmental protection acceptance of the 3000 tons/year hexafluoropropane project (re approved). The total investment of this project is 86.5 million yuan, mainly for the construction of a new production plant and a potassium hydroxide recovery workshop, as well as the construction of other supporting facilities. After production, it can produce 3000 tons of hexafluoroepichlorohydrin, 500 tons of carbonyl fluoride, and 1000 tons of trifluoroacetyl fluoride annually. The project started construction in December 2024 and was completed and put into commissioning operation in February 2025.

04Zhejiang Jianli Chemical's annual production of 2000 tons of lithium hexafluorophosphate project has been successfully put into operation

Recently, the construction project of Zhejiang Jianli Chemical with an annual output of 2000 tons of lithium hexafluorophosphate, undertaken by China Construction Engineering Corporation, was successfully put into operation in one go. It is reported that Zhejiang Jianli Chemical's annual production of 2000 tons of lithium hexafluorophosphate project belongs to Zhejiang Jianli Chemical Co., Ltd.'s annual production of 20000 tons of lithium hexafluorophosphate, 5000 tons of lithium difluorosulfonyl imide, 2000 tons of ethylene carbonate, and 50000 tons of lithium battery electrolyte new energy material construction project. The total investment of the construction project is 5.18 billion yuan, and the address is Modern Pharmaceutical and Chemical Industry Park, Xianju Economic Development Zone, Taizhou, Zhejiang.