IOL Fluorine Chemical Weekly: Refrigerant Market Faces Tight Supply-Demand Balance, Cross-Year Trend May Continue at High Levels

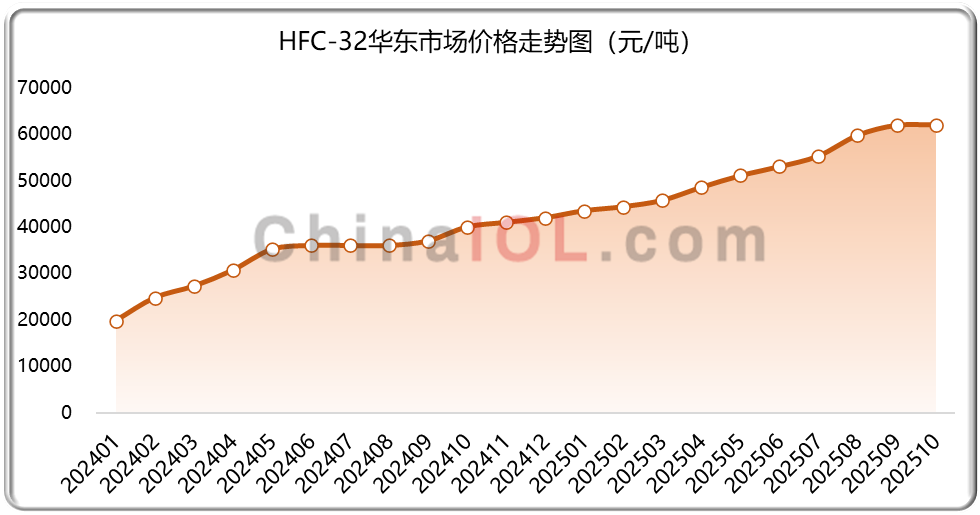

This week, most refrigerant products in the market remained stable, with some products experiencing slight price increases due to factory shutdowns, while both the domestic and foreign markets remained overall steady. At the end of the year, the remaining quotas for different products vary significantly, and factory quota adjustments and production strategies directly impact the market. Weekly market characteristics: The price of upstream raw material fluorite powder continued to rise, while although the price of hydrofluoric acid also increased, the dilemma of being squeezed between upstream and downstream sectors persisted. During the week, R22 prices experienced a significant decline, yet there was still room for negotiation in actual orders. Popular products such as R32, R410A, and R134a maintained a strong market performance, while R125 saw reduced volume and rising prices at the year-end, with effective supply and demand also operating in a tight balance. In summary, the year-end market exhibited features of low-end cost increases and tight supply-demand balance, with the cross-year trend potentially extending to higher levels.

Fluorinated polymers: Maintaining a weak equilibrium, prices hovering near the bottom

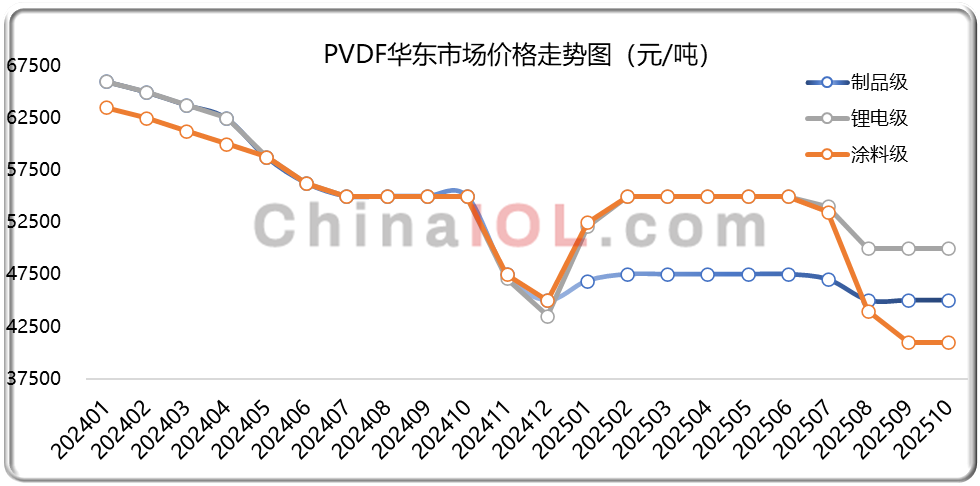

This week, the fluoropolymer market maintained a weak equilibrium, with product prices nearing the bottom range. Companies actively controlled production to stabilize prices and manage inventory. Upstream raw material cost support strengthened, but its downstream transmission remained limited. On the demand side, traditional industries showed steady recovery, while growth in the new energy sector was sluggish. Prices are expected to continue fluctuating at low levels in the short term. Industry highlights include increased attention to high-performance fluorinated chemicals such as PEEK for robotics and fluorinated liquids for liquid-cooled servers, which are forming new growth drivers. Supply of key intermediates—TFE, HFP, and VDF—remained ample, with prices hovering near the cost line. The recovery in fluoropolymer markets was primarily constrained by demand-side factors. PTFE faced a dual challenge of insufficient capacity utilization and reliance on imports for high-end products. FEP benefited from significant growth in emerging application demand, while PVDF and fluororubbers were constrained by overcapacity from recent large-scale expansions, coupled with shifts in alternative materials and application scenarios, leading to intensifying market competition.

Weekly News

01Announcement of the Fourth Generation Environmental Protection Refrigerant Pilot Project of Sanmei Corporation

Recently, the pilot platform project (Phase I) of Zhejiang Sanmei Chemical Co., Ltd. in Wuyi County New Materials Industrial Park was announced. The project is located in Wuyi County New Materials Industrial Park and is expected to invest 30.9 million yuan to construct a 1000t/a tetrafluoropropene (HFO-1234yf) pilot plant, a 200t/a 1,1,1,3,3-pentachloropropane (HCC-240fa) pilot plant, a 200t/a 1,1,1,3-tetrachloropropane (HCC-250fb) pilot plant, a 1000t/a a1-chloro-3,3-trifluoropropene (HCFO-1233zd) pilot plant, and a 1000t/a trifluoropropene (HFO-1243zf) pilot plant. One set of 200t/a perfluorohexane and 100t/a hexafluoropropylene trimer pilot plant, and one set of 150t/a difluorochloroethane (HCFC-142b) pilot plant

02Announcement of 120000 ton fluorite open-pit mining project in Ejina Banner

On October 15th, the Ejina Banner Branch of the Ecological Environment Bureau of Alxa League announced the first public announcement of the 120000 ton/year open-pit mining project of the fluorite mine in the Hongliugou mining area of Ejina Banner, Inner Mongolia Autonomous Region, by Fujian Fuxin Investment Co., Ltd. The project is located in Ulanwulagacha, Haribuligeyinwula Town, Ejina Banner, Alxa League, Inner Mongolia Autonomous Region, with a construction scale of 120000 tons/year for open-pit mining of fluorite ore.

03The first phase acceptance of the 4500 ton hydrogen fluoride ether technical renovation project in Fujian's agriculture, rural areas and farmers

On October 10th, the environmental protection acceptance of the second phase of the fluorine fine chemical technology renovation project (Phase I) of Fujian Sannong New Materials Co., Ltd. was announced on relevant websites. The project is located in the Huangsha New Materials Circular Economy Industrial Park in Sanming City, with an actual investment of 19.24 million yuan. The first stage acceptance includes 1000t/a of HFE-254, 1000t/a of HFE-347, 2000t/a of HFE-374, and 500t/a of HFE-458. Two stages (not yet built): 100 tons/year of perfluoron-propyl vinyl ether (PPVE), 20 tons/year of diiodotetrafluoroethane, 10 tons/year of diiodooctafluorobutane, and 5 tons/year of diiodoperfluorohexane.

04Sichuan Yongjing 72000 ton electronic grade fluorine chemical project announcement

Recently, the People's Government of Zigong City issued a notice for the first public announcement of the annual production of 72300 tons of electronic chemicals and electronic special gases project of Sichuan Yongjing New Materials Co., Ltd. The project is constructed in the Chuannan New Materials Chemical Industrial Park in Zigong City, Sichuan Province. The main products include 12000 tons of high-purity ammonia, 10000 tons of BOE solution, 30000 tons of semiconductor grade ammonia water, 20000 tons of semiconductor grade hydrofluoric acid, 200 tons of semiconductor grade hydrogen fluoride, and 120 tons of semiconductor grade fluorine nitrogen mixture.