IOL Fluorine Chemical Weekly Report: Post-Holiday Refrigerant Market Sees Narrow Rises in Popular Products

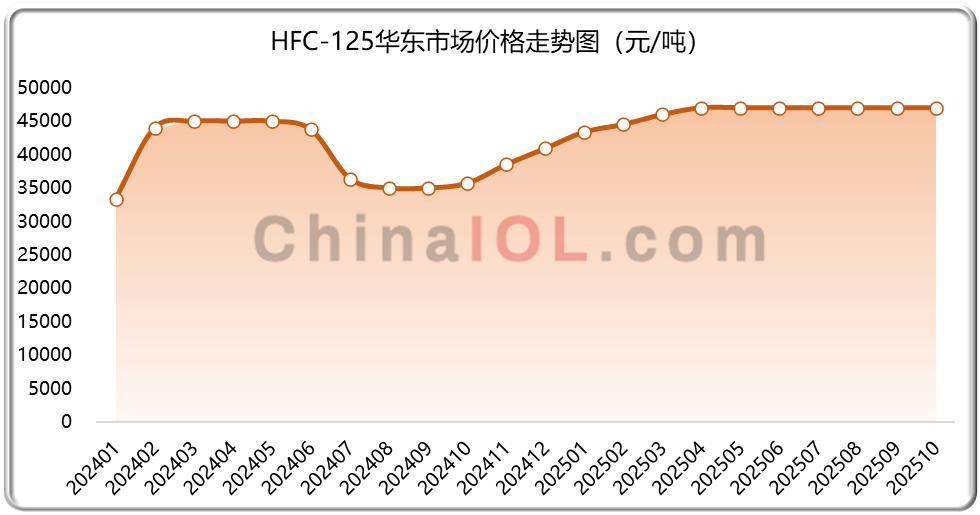

Refrigerant: Supply-Demand Remains Tightly Balanced, With Domestic and Foreign Sales Maintaining an Upward Trend

This week, the post-holiday refrigerant market saw modest price increases for popular products, while non-popular products maintained firm quotations, with actual orders benefiting from negotiated discounts. Both domestic and international markets remained stable overall. As the year draws to a close, production quotas are dwindling, leading to frequent price negotiations across different products and factories, with most actual orders aligning with higher price ranges. Market trends for the week: With air conditioner manufacturer supply prices finalized in the fourth quarter, popular products such as R32, R410A, and R134A continued their robust and steady performance. In the late-year market, product quotations increasingly depend on factory availability, supply volume, and the validity of offers. In summary, tight supply-demand balance remains a defining feature of the current market, with firm product prices sustaining active trading activity. The refrigerant market's year-end performance continues to show strong momentum. Notably, the 2026 HFC refrigerant product-specific quota policy may increase single-product adjustments by up to 30%, potentially boosting industry supply in the new year and effectively alleviating supply-demand imbalances.

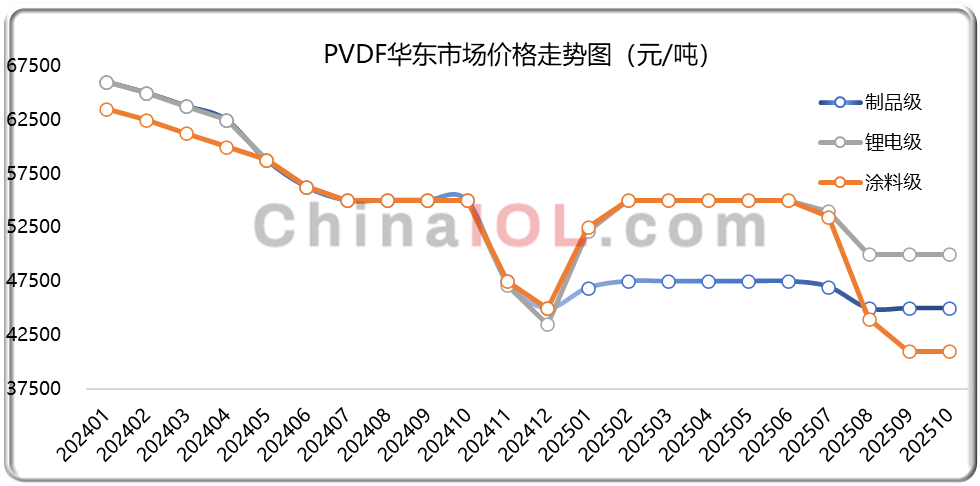

Fluorinated polymers: Maintaining a weak equilibrium, prices hover near the bottom

This week, the fluoropolymer market maintained a weak equilibrium, with product prices nearing the bottom range. Companies actively controlled production to stabilize prices and manage inventory. Upstream raw material cost support has strengthened, but its impact on downstream sectors remains limited. On the demand side, traditional industries showed steady recovery, while growth in the new energy sector remained sluggish. Prices are expected to continue fluctuating at low levels in the short term. Notable industry highlights include increased attention to high-performance fluorinated chemicals such as PEEK for robotics and fluorinated fluids for liquid-cooled servers, which are emerging as new growth drivers. Among major product categories, intermediate products like TFE, HFP, and VDF faced upstream and downstream pressure, generally hovering near the cost line. PTFE encountered a dual challenge of insufficient capacity utilization and reliance on imported high-end products. FEP benefited from significant growth in emerging application demand. PVDF and fluororubber, however, faced intensified market competition due to substantial overcapacity from recent years of rapid expansion, coupled with changes in substitute materials and application scenarios.

Weekly news

01Planning and Construction Phase of Weihua New Materials Fourth Generation Refrigerant Project

Recently, Weihua New Materials held a semi annual performance briefing and related research activities for 2025, responding to questions about the company's development status, project progress, and industrial layout. Among them, the company stated that it will jointly establish a joint venture with Meilan New Materials to lay out the fourth generation refrigerant, and the joint venture will entrust its controlling subsidiary Fanghua Chemical for processing. We are currently in the stage of equipment procurement, planning and construction.

02Honeywell Advanced Materials (China) Co., Ltd. and China Automotive Data Corporation officially signed a memorandum of cooperation

On September 25, 2025, Honeywell Advanced Materials (China) Co., Ltd. (Honeywell) and China Automotive Data Co., Ltd. (China Automotive Data) signed a memorandum of cooperation on "Research on Automotive Air Conditioning Refrigerant Leakage and Control" in Shanghai. Feng Yi, General Manager of Zhongqi Data, and Li Baogang, General Manager of Honeywell High Performance Materials Asia Pacific, signed an agreement on behalf of both parties to focus on the needs of mixed refrigerant leakage investigation and control, and to build a specialized technology development and verification platform. Accelerate the process of reducing and replacing HFC refrigerants in the automotive industry, injecting new momentum into the low-carbon and sustainable development of the automotive industry.

03Gansu Juhua Silicon Fluoride New Material Project is expected to be put into operation in the third quarter of 2026

Recently, it was learned from relevant departments that the high-performance silicon fluorine new material integration project of Gansu Juhua New Materials Co., Ltd., located in the old city area of Yumen City, has completed a cumulative investment of 4.89 billion yuan. The main items of the project's 10 sections have opened up 160 working faces, accounting for 78% of all working faces. The project has officially entered a new stage of main construction, with a plan to achieve mid-term handover in June 2026 and start trial production in the third quarter of the same year. It is reported that the total investment of the project is 41.047 billion yuan, and it is planned to build new facilities with an annual output of 360000 tons of industrial silicon, 100000 tons of polycrystalline silicon, 50000 tons of trichlorosilane, 125000 tons of fluoropolymers, 150000 tons of AHF, 300000 tons of calcium chloride, 300000 tons of sulfuric acid, 240000 tons of calcium carbide, 900000 tons of ion membrane caustic soda (comprehensive utilization of self-produced waste salt in this project), etc.

04Xinzhoubang: The current production capacity of perfluoropolyether is 2500 tons, and there is still a significant expectation of improvement in the future

Recently, Xinzhoubang announced on the investor interaction platform that the company's current production capacity of perfluoropolyether products is 2500 tons. After the "Haisifu Annual Production of 30000 Tons of High end Fluorine Fine Chemicals Project" under construction is put into operation, the perfluoropolyether production capacity will be significantly increased accordingly. The exit of international mainstream companies will have a corresponding positive impact on the company's performance. With sufficient fluorine liquid production capacity and mature product technology, the company can quickly respond to market demand, actively connect with customers and carry out certification imports. During the supply switching window period, the company's fluorine liquid product shipments and sales will maintain steady growth.