IOL Fluorine Chemical Weekly Report: Refrigerant Prices Stable Amid Year-End Volume Decline; Fluorine-Based Lithium Battery Materials Prices Continue to Rise

Refrigerant: Market Volume Shrinks, Prices Remain Stable at End of Year, with Demand Driven Primarily by Necessity

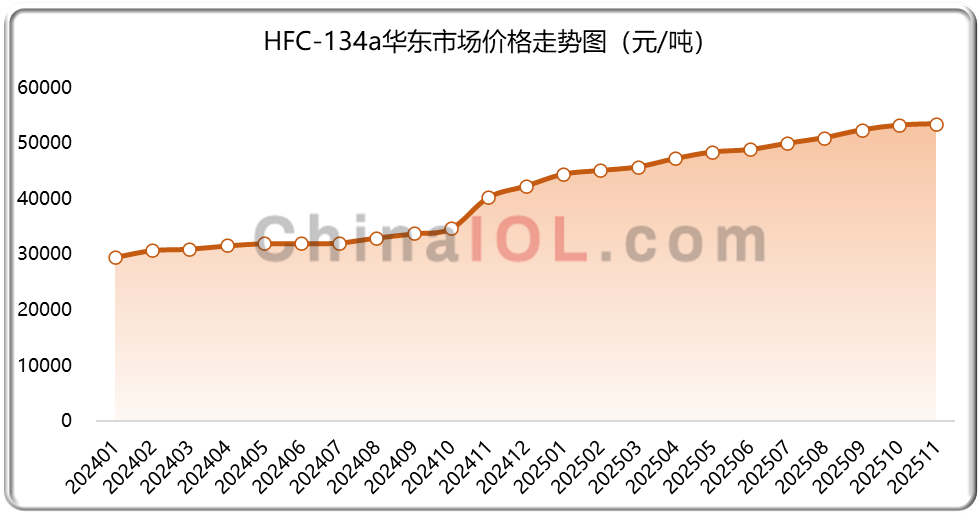

This week, the refrigerant market exhibited distinct end-of-year characteristics, with a smooth transition in both supply and demand, maintaining an overall trend of shrinking volume and stable prices. Weekly market highlights: In the final quarter, refrigerant manufacturers reduced production loads, leading to decreased production and sales volumes, which in turn lowered demand for raw materials. Prices of upstream fluorite powder, hydrofluoric acid, and other raw materials faced further downward pressure, with more declines than increases. On the demand side, air conditioner manufacturers are expected to resume production schedules by year-end, while maintenance and foreign trade activities remain in a slow season. Between refrigerant factories and traders, demand primarily remains driven by essential needs, with minimal stockpiling activity. In the late-year market, the strong sales of R32 and R134A continued, contributing positively to the release of both long-term and short-term orders.

Fluorine-containing polymers: Accelerated production capacity release speeds up industry consolidation as the market enters a phase of existing stock competition

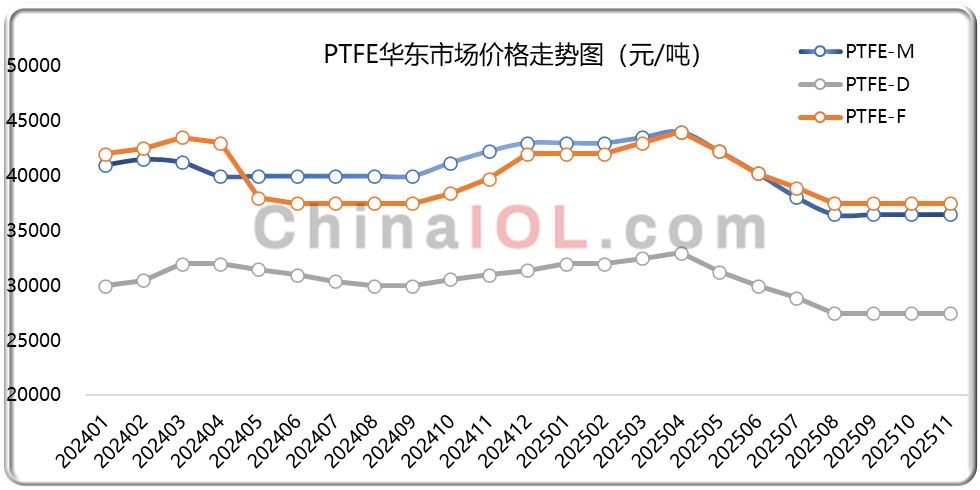

This week, the mainstream products in the fluoropolymer market operated weakly stable, while fluorine-containing lithium battery materials such as lithium hexafluorophosphate and electrolytes remained tight in supply and demand, with prices continuing to rise. On the supply side, leading enterprises like Juhua, Chenhang, and Livin conducted shutdown maintenance at the end of the year, which helped alleviate the supply-demand imbalance. On the cost side, the prices of upstream raw materials remained at a low level for an extended period, and sporadic adjustments had limited impact on downstream costs. On the demand side, sectors such as semiconductors, new energy, electronic information, and high-end manufacturing continued to experience rapid growth, forming the core incremental market for fluorine materials. By product category: - The supply of organic fluorine monomers (TFE, HFP, VDF) was relatively loose, with prices hovering near the cost line. Mainstream manufacturers had high self-sufficiency rates, and external procurement was limited. - PTFE exhibited a structural contradiction between low utilization rates and reliance on imports for high-end products. - FEP saw significant demand growth driven by emerging applications. - PVDF and fluororubber faced intensified market competition due to substantial capacity expansion, coupled with the emergence of alternative materials and shifts in application scenarios. The weakly stable trend of mainstream products is expected to persist in the short term.

Weekly news

01Weihua New Materials: Fourth generation refrigerant is expected to undergo trial production in the first half of 2026

On October 31st, Weihua New Materials released an announcement to respond to recent issues of common concern to investors. Among them, the company stated that it has established a joint venture with Meilan New Materials to lay out the fourth generation refrigerant, and the joint venture has entrusted its controlling subsidiary Fanghua Chemical for processing. We are currently in the stage of equipment procurement, planning and construction, and expect to conduct product trial production in the first half of next year. The patent protection period for the fourth generation refrigerant is not uniform due to differences in specific categories, technologies, and enterprises. Some relevant patents will indeed expire next year, but there is no unified standard for the specific time, and the expiration dates of different patents vary

02Fujian Huateng Mining's 80000 ton fluorite powder technical renovation project announced

On November 5th, the Ecology and Environment Bureau of Sanming City plans to accept and publicize the Environmental Impact Assessment Report of Qingliu Huateng Mining Co., Ltd.'s Qingliu Huateng Mining Fluorite Fine Powder Technical Renovation Project. The project has added an investment of 60 million yuan and plans to phase out the existing 30000 ton fluorite powder production line, purchase and update equipment such as ore crushers, classifiers, and plate conveyors, and transform it into an 80000 ton fluorite powder production line. At the same time, a non operational explosive warehouse (with an explosive storage capacity of 5 tons and a detonator storage capacity of 20000 rounds) will be built, and the CaF2 content of fluorite powder will be ≥ 97.5%.

03Announcement of the Technical Renovation and Capacity Expansion Project of Lithium Hexafluorophosphate Subsidiary of Xinzhoubang

On November 3rd, the Administrative Approval Bureau of Ganzhou City publicly announced the basic situation of the annual production capacity expansion project of 18000 tons of lithium hexafluorophosphate in Shilei Fluorine Materials Huichang. The project is located in Huichang Fluorine Salt Chemical Industry Base in Jiangxi Province, with a planned investment of 56.49 million yuan to carry out technological upgrades on the existing 6000 ton lithium hexafluorophosphate project. After the technological transformation, the products and production capacity of this project are: 18000t/a lithium hexafluorophosphate, 2400t/a hydrogen fluoride byproduct, and 72000t/a hydrochloric acid byproduct.

04India makes final ruling on second anti-dumping sunset review of China's fluororubber

On October 29, 2025, the Indian Ministry of Commerce and Industry issued an announcement, making a positive final ruling on the second anti-dumping sunset review of fluororubber (FKM) originating from or imported from China. It is recommended to continue imposing anti-dumping duties for a period of 5 years, with a tax amount of 1.04-8.86 US dollars per kilogram, as follows: producer Daikin Fluorochemicals (China) Co., Ltd. is 1.04 US dollars per kilogram, Zhonghao Chengguang Chemical Research Institute Co., Ltd. is 1.30 US dollars per kilogram, Chengdu Chengguang Boda Rubber Co., Ltd. is 3.85 US dollars per kilogram, and other Chinese producers are 8.86 US dollars per kilogram. The products involved in the case are fluororubber, including copolymer fluororubber, ternary copolymer fluororubber, copolymer rubber, copolymer premix rubber, ternary bisphenol curable rubber, ternary peroxide curable rubber, and ternary bisphenol curable rubber, but do not include fluororubber compounds and perfluoroether rubber (FFKM). The Indian customs codes for the products involved are 39045090, 39046990, 39049090, and 39046910.